Article

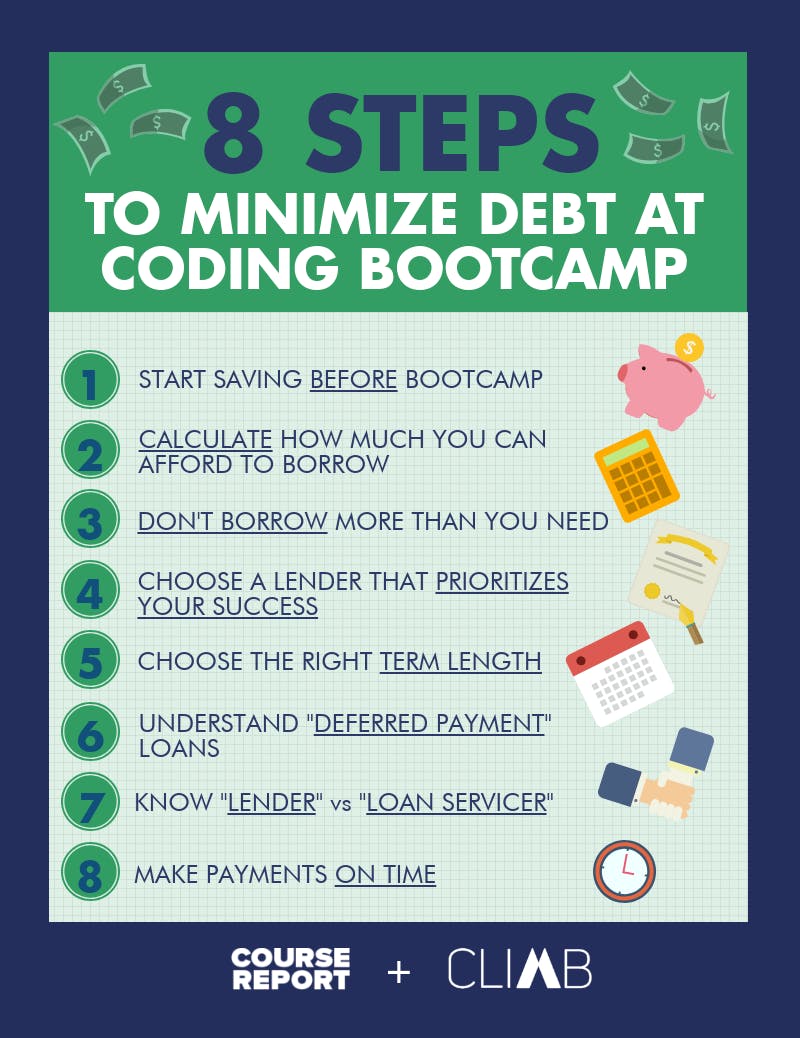

8 Steps to Minimize Your Coding Bootcamp Debt

![]()

Written By Rachel Seitz

Protect your data

We use cookies to provide our services, improve the user experience, for analysis and marketing purposes. By giving your consent, you also agree that your data may be transferred to the USA by the use of cookies. You can revoke your consent at any time. You can find further information in our privacy policy and cookie policy.

![]()

Written By Rachel Seitz

Course Report strives to create the most trust-worthy content about coding bootcamps. Read more about Course Report’s Editorial Policy and How We Make Money.

Course Report strives to create the most trust-worthy content about coding bootcamps. Read more about Course Report’s Editorial Policy and How We Make Money.

If you’re planning to take out a loan to pay for your coding bootcamp tuition, READ THIS FIRST. Borrowing money can be confusing and stressful, but there are a number of ways to make sure your debt doesn’t pile up more quickly than you were expecting. The team at Climb Credit, a student lender focused on career-building education, drew from their experience working with bootcamp students to put together this list of ways to be smart about your loan, and avoid accruing unmanageable debt by the time you graduate.

So how can you minimize your student loan debt?

In the months before you begin class, spend some time putting together a budget. One thing that makes managing a budget easier is a budgeting tool, whether you need one created for you, or want to make a personalized one.

Some specific actions you can take to save up money before school are:

Cost undoubtedly impacts your decision, but the importance of cost depends on a students’ circumstances. You should also consider the end result; not just the initial investment. The tuition at one bootcamp may be higher, but also provide better class resources and career support. If a student can land a better job with a higher salary after graduation, then the education could more than pay for itself.

Looking online and reading reviews on websites like Course Report, visiting campuses, and hearing from alumni can help you get an idea about whether the price is worth the product, and whether you will get a good return on investment – which is especially important if you’re going to be taking out a loan.

PRO TIP: You only want to borrow enough to help you through your education – an education that gets you to your career goals.

The amount you need to borrow depends on each individual student’s situation. If you aren’t working but still need to buy groceries, pay rent, or pay any other living expense, then borrowing some extra money for living costs on top of the tuition can be beneficial.

But it’s important to figure out exactly how much you’ll really need – track your spending, and then figure out which things are necessary expenditures. Borrowing more living expenses than necessary may be tempting, but you’ll just need to pay more back in principal and interest down the road.

Look for a lender which places a priority on the success of the students, rather than just getting money back from them. Climb’s mission is to make the education we finance work for students – we evaluate each program we partner with and only offer financing for programs that pass our return-on-investment evaluation. And throughout our relationship we continue to assess our partner schools, taking the success of graduates and the experiences they had during and after their courses very seriously.

The ideal term length for each individual student will depend on two factors:

Oftentimes, the faster you pay off your loan, the less you’ll pay in interest in the long term. This may not work for everyone, though – with a shorter term length, you’ll also have higher monthly payments. Some students may need a longer loan in order to have lower, more manageable payments. With Climb, you can prepay without penalty, and you can pay more than your monthly payment, so it might be better to have lower monthly payments with the option to pay more if you have extra cash that month! Borrowers should balance paying less overall with how much they can comfortably pay each month.

At Climb, many of our loans begin with an interest-only period, or a period during and immediately after school when a student pays only the interest amount on their loan. These payments stop additional interest from accruing while students are in school.

Other loans may defer any payment at all until after the program. This can be a benefit for students who aren’t working and haven’t saved up money to make payments while in class.

However, even when payments are deferred, interest could still be accruing, so students might emerge from class facing more debt that built up during school. By making interest payments while in school, students can help keep their debt lower.

Make sure you’re familiar with both your lender and your loan servicer: your lender provides the loan, and the loan servicer handles payments and billing. That way, if you notice a mistake or want to make a change to your account, you’ll know who to contact in order to get these changes made as quickly and efficiently as possible.

A great way to stay on top of your loan is to make payments while in school, or to pre-pay if you can. We recommend setting up automatic payments. This ensures you won’t forget about a due date, which would drag out the loan term and pile up the debt owed. Many lenders – including Climb – offer an interest rate discount for setting up autopay. Climb borrowers receive a 0.25% interest rate reduction as long as their accounts are connected to autopayments (which over time really adds up).

FURTHER READING:

In doing the return-on-investment analysis, Climb relies on data from public sources and schools. Climb has no ability to independently verify this information and offers no representation or warranty as to the accuracy or completeness of any data. Inaccuracies in the underlying data will have a corresponding result in Climb's analysis. Climb reserves the right to change its ROI analysis in its complete discretion, at any time, without notice. Climb's ROI analysis provides no representation, warranty, or guaranty that any individual will achieve any particular outcome at a given school. All prospective students should do their own analysis of the costs and benefits of attending any particular school.

Climb Credit (NMLS #1240013)

Rachel is the Marketing Associate at Climb Credit. Climb Credit finances education through private student loans, and has a focus on career-building education. Climb partners with a number of coding bootcamps and vocational schools to offer tailored loans.

Black Friday + Cyber Monday Deals for Coding Bootcamps in 2023

From Scholarships to Deferred Tuition to Financing — Learn how to make your tuition affordable!

Find out how to make the Springboard tuition affordable for your budget!

Find out the 5 ways to make your General Assembly tuition affordable for you!

Find out if you can use your 529 account to pay your coding bootcamp tuition!

Roger from Springboard answers this reader's question!

What you can expect from the Niantic-sponsored cohort at Tech Elevator!

Liam took out an Ascent loan + living stipend for a bootcamp – find out if the loan was worth it!

Christine took out a Climb loan to attend a UX bootcamp – find out if the loan was worth it!

How to use a WIOA grant towards your Coding Temple tuition!

Just tell us who you are and what you’re searching for, we’ll handle the rest.